Spain: Storage takes off in earnest

Spain has set an ambitious and necessary target to achieve 81% renewable penetration by 2030: reaching 22.5 GW of storage capacity by that date.

Early in the year, progress looks promising, with 18 GW already authorized for stand-alone battery projects and another 10 GW under evaluation.

The path forward is not without obstacles. Regulatory hurdles, administrative barriers, and grid access limitations demand an accelerated transition towards smart, distributed power grids.

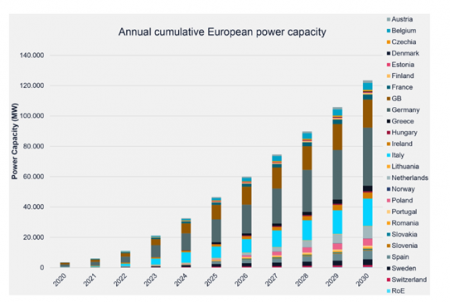

Europe to increase installed storage capacity sixfold

Europe is also experiencing strong growth momentum. The European Association for Storage of Energy (EASE) projects exponential growth, estimating that installed capacity will increase sixfold before 2030.

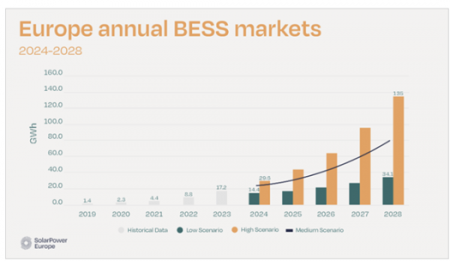

Even more optimistic, SolarPower Europe forecasts that total battery storage capacity will reach 260 GWh by 2028 in Europe—seven times current levels.

Source: EASE, European Market Monitor on Energy Storage (EMMES), March 2024 data.

Source: SolarPower Europe, chart published by SmartGridInfo.

These projections are reinforced by the International Energy Agency (IEA), which now projects global electricity demand in 2035 to be 6% higher than it predicted in 2023. The world is expected to add more than 900 TWh of annual electricity demand each year. The IEA emphasizes the importance of investment in storage and distributed grids as key pillars for driving the energy transition.

Financing storage: Hybridization and the Capacity Market

If storage is needed to integrate more renewable generation, logic dictates that renewable generators will drive the integration of storage into their plants. For this reason, hybrid renewable plants should be given priority in permitting processes.

However, when storage is connected to the grid, it relies on capacity remuneration, as it cannot directly monetize the benefits it provides to the power system. This explains the importance of properly implementing the capacity market and considering all options to limit the impact on electricity prices for end consumers, while ensuring the necessary infrastructure for grid connection and integration.

The Capacity Market: A significant milestone

The implementation of the capacity market in Spain will mark a milestone in 2025, with the first auction expected in the first half of the year, led by MITECO. This mechanism, approved in December 2023 and developed throughout 2024, seeks to ensure security of electricity supply by remunerating firm capacity availability.

Its structure, based on competitive auctions and payments for guaranteed capacity, is particularly favorable to energy storage. The system will provide stability and security for investments, reducing risks and complementing day-ahead market revenues. Successful implementation will help reduce price volatility and facilitate the deployment of storage technologies in the energy mix.

Falling battery costs: What will the market impact be?

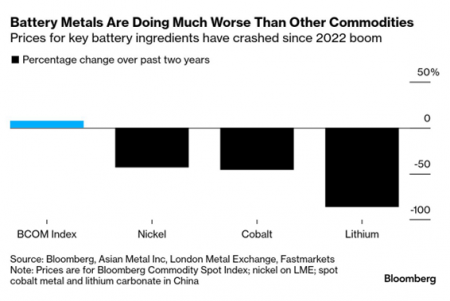

Another key aspect of the market analysis is the sharp reduction in lithium-ion battery costs, which has had a significant impact on storage deployment.

Lithium-ion battery costs have dropped by approximately 80% over the past decade, making large-scale storage projects increasingly viable and expanding adoption across geographies and sectors.

Metal price evolution. Source: Bloomberg.

This is particularly relevant in photovoltaic (PV) projects, where the addition of competitively priced storage is helping to solve intermittency issues and increase the utilization of generated energy.

Goldman Sachs and other analysts project a continued decline in lithium battery prices, with reductions of up to 50% expected between 2025 and 2026.

Lower costs will accelerate the inclusion of storage in residential and industrial energy projects. Some studies indicate that by 2025, 40% of new residential PV installations will include battery storage.

However, if battery prices continue to fall in 2025, this may not be solely due to lithium costs (the mining sector is already operating at capacity limits), but also to technological advances, efficiency improvements, and economies of scale.

Innovation and tecnlology development: towards diversification

The technological landscape of energy storage is undergoing an unprecedented transformation.

While lithium-ion batteries will maintain their dominant position, 2025 will see the emergence of promising alternative technologies. These include redox flow batteries, which stand out for large-scale capacity and lower degradation, and sodium-ion batteries, offering a more cost-effective alternative.

The integration of artificial intelligence into battery management systems (BMS) will be transformative. These systems will learn and optimize usage patterns in real time, enabling more accurate predictions of battery lifetime, optimization of charge/discharge cycles, automated load management (load profiles), and the development of predictive maintenance strategies.

AI integration into BMS will become a reality in 2025.

We also expect long-duration energy storage (LDES) technologies to make significant advances, addressing the critical need to manage renewable intermittency. While Spain’s National Energy and Climate Plan (PNIEC) outlines GW targets for 2030, we believe specifying GWh targets is essential, since long-duration storage is where the main challenges lie.

Footprint reduction and energy-efficiency improvements will be other key areas of innovation. Manufacturers are developing more compact and efficient designs, particularly targeting residential, industrial, and commercial markets.

In these markets, we will see next-generation materials integrated into systems to improve energy density, higher-efficiency thermal management, and modular designs for easier installation and maintenance.

Long-duration storage, equipment downsizing, and energy efficiency improvements will be central to manufacturers’ innovation strategies.

The Internet of Things (IoT) will also revolutionize monitoring and control of storage systems. Advanced sensors will enable automated storage network management, improved reliability through fault analytics, and early fault detection.

Sustainability and second life: advances in circularity

Battery recycling and second-life applications will undergo major transformation. New technologies will allow recovery of up to 84.5% of lithium and 60.2% of cobalt from used batteries. Companies such as Naturgy and Mercedes-Benz are leading the way, deploying storage systems with repurposed EV batteries, building installations of up to 12 MW.

Apple has already announced its goal of using 100% recycled cobalt, while the European industry is developing infrastructure to recycle nearly half of installed battery capacity. These projects not only provide sustainable solutions but also create new economic opportunities, supporting the energy transition and the growth of the recycling industry.

Cybersecurity: A new challenge

In 2025 and beyond, battery storage technology providers will focus on two key cybersecurity trends: the integration of invisible ambient intelligence to enhance device security and traceability, and the development of systems to counter false-data injection and tampering, ensuring the integrity of performance and state-of-health (SoH) data.

These measures reflect the growing importance of cybersecurity in the sector, as batteries increasingly become critical components of both energy and transport infrastructure.

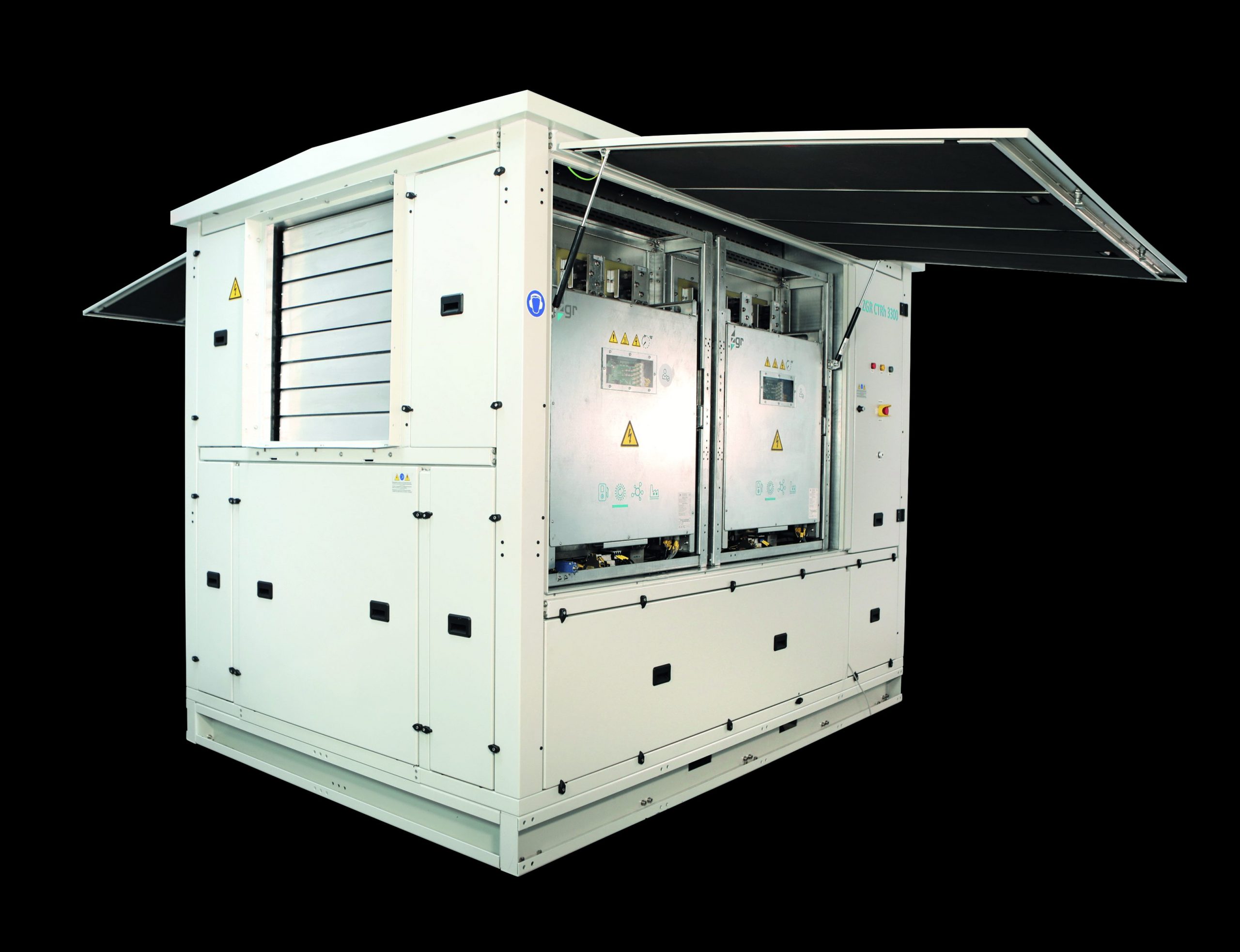

ZGR Corporación: leading the way in 2025

In 2025, at ZGR Corporación, we will continue to lead with the most innovative battery storage solutions, both for hybridization with photovoltaic, wind, and industrial projects, and for stand-alone deployments on distribution networks. Our commitment to delivering the most flexible, robust, and high-performance solutions for end-to-end energy management continues to position our equipment among the most highly valued in the market—such as the new ZGR PCS 3300, and this year’s launch of the ZGR PCS 4500, once again anticipating demand and delivering solutions aligned with industry requirements.

If you have an energy storage project, contact us and share it with our team. Our technical experts will be delighted to contribute their extensive experience and knowledge, offering you innovative, customized, and high-value solutions.

Your energy, our challenge.

Stay up to date with our activity by subscribing to our newsletter and joining our LinkedIn Community.