A NEW REGULATION AND STABLE FRAMEWORK

The agents in the electricity sector agree on the need for a new regulation and a stable framework to ensure and promote investments in the short, medium and long term. In Spain, the implementation of a centralised market is proposed, led by Red Eléctrica de España, to contract the required power, including system reinforcement services that the energy-only market does not provide.

It must be understood that capacity mechanisms in electricity markets ensure that there is always enough electricity available when we need it. They do this by adding more energy to the system when demand is high or reducing energy when demand is low.

For this reason, the capacity market involves the integration into the electricity market of combined cycle plants when they have to back up the system, the different forms of storage (batteries and pumping) or the possibility that large electricity-intensive consumers may prefer to stop or reduce loads in exchange for economic incentives. In the future, other figures could also participate, such as a demand adder.

The Capacity Market provides for more stable regulation and offers clear signals that encourage investment and the development of new energy infrastructure.

CAPACITY MARKET, SECURITY OF SUPPLY AND STRATEGIC OBJECTIVES

The Capacity Market contributes to guaranteeing the security of electricity supply by always maintaining a balance between energy supply and the demand. Furthermore, this market is aligned with the country’s energy objectives, increasing the penetration of renewable energies and the incorporation of storage technologies. In detail, the objectives that have been set and that this new management model should help to achieve are as follows:

- Renewable energies: 81% of electric generation.

- Increased storage: 12 GW

- Combined cycles: 26,6 GW

- Orderly shutdown of the nuclear power plant: -4,2 GW in 2027

- Continuous security supply

The Capacity Market provides a more stable regulation and gives clear signals that encourage investment and the development of new energy infrastructure.

CAPACITY MECHANISM MODELS

Different models of capacity mechanisms have been identified, such as strategic and payments per capacity, with the objective of promoting long-term investment through centralised or decentralised volume signals.

These mechanisms are essential to stimulate investments in generation capacity and ensure security of electricity supply, avoiding the premature closure of infrastructure necessary for the system.

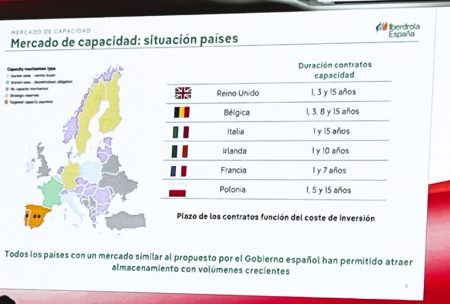

As evidenced in RENMAD, all countries with a Capacity Market similar to the one proposed by the Spanish Government have managed to attract storage with increasing volumes, with contract durations ranging from 1.3 to 15 years.

Market Capacity – Situation by country. Source: Iberdrola – Renmad Storage – March 2024

THE CAPACITY MARKET AND SUPPORT FOR RENEWABLE ENERGIES

The introduction of capacity mechanisms is essential to support renewables energies by providing an economic signal encouraging generators to invest and operate efficiently. This, at such an important time for the promotion of solar energy in our country, is fundamental.

This measure helps to avoid the early closure of infrastructure necessary for the system due to low operating profitability, ensuring the stability and reliability of the electricity supply in a context of transition towards a cleaner and more sustainable energy matrix.

INCENTIVES FOR INVESTMENT IN STORAGE

In a context where a significant increase in storage capacity is expected, capacity mechanisms provide the necessary stability and security for investments, enabling the growth of this crucial infrastructure for the integration of intermittent renewable sources.

It should also take in mind that there is currently a mismatch between electricity supply and demand that is putting a strain on the system. Although the PERTE subsidies have been a good instrument for bringing forward investments in storage, more demand is required for investments to be worthwhile. In view of this, the Capacity Market could be the key to regulating these imbalances.

With new regulation and appropriate mechanisms, there is potential to boost investments in storage technologies and modernise electricity grids; support renewables and ensure the security of electricity supply in the country. The Capacity Market can contribute to advancing the energy transition and boosting electrification, with a more resilient, flexible and sustainable model.

At ZGR, as experts in advanced stand-alone and hybridised energy storage systems; solar inverters for solar plants; voltage rectifiers and chargers for electrical infrastructures and advanced grid quality solutions for industry, we believe that developing and regulating the Capacity Market as soon as possible is critical for the sector and the future of our country’s electrical energy.